first time investor

Financing your first investment property 1-4 family.

FIRST TIME INVESTORS

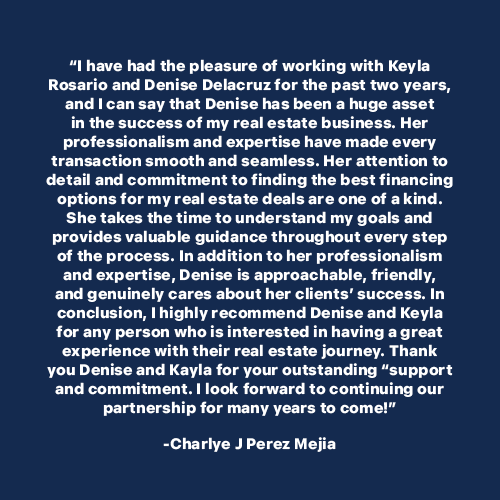

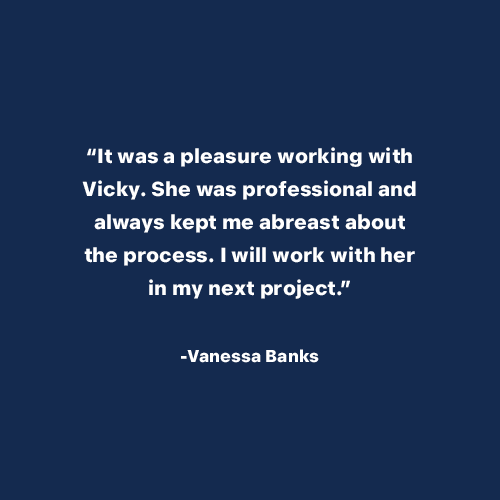

First-time investors often face limited financing options and considerable confusion. However, there are product options available, and Home Qualified can provide first-time investors with access to them.

Low Barrier to Entry

Flexible down payment options and competitive terms make it easier to purchase your first investment property.

Designed for Beginners

Tailored programs for first-time investors with clear guidance and support through every step.

Access to Expert Support

Education, mentorship, and resources included to help avoid costly mistakes.

Flexible Loan Options

Financing that fits a variety of property types (single-family, multi-family, condos, etc.).

Credit-Friendly Options

Programs available even if you don’t have perfect credit or a long financial history.

Looking to build a home, buy a fixer upper & repair or invest in a real estate project long term?

We can help you find the solution.

Our partners can give you more options to qualify and get you more financing than traditional lenders. No income programs available, No credit score needed, No limit on properties financed, No limit on cashout.

APPLY NOW!

Loans Subject to Credit, Property, and Underwriting Approval by Third-Party Mortgage Lenders. All mortgage loan applications are subject to credit and property approval, along with other underwriting rules and requirements. Rates, program terms, and conditions are subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations may apply.